Bild 1 von 12

Galerie

Bild 1 von 12

Ähnlichen Artikel verkaufen?

Hedgefonds: Eine analytische Perspektive Andrew W. Lo Softcover

US $25,50

Ca.CHF 20,56

Artikelzustand:

“Like New Softcover, Clean, tight, no markings. Appears as unread”

Neuwertig

Buch, das wie neu aussieht, aber bereits gelesen wurde. Der Einband weist keine sichtbaren Gebrauchsspuren auf. Bei gebundenen Büchern ist der Schutzumschlag vorhanden (sofern zutreffend). Alle Seiten sind vollständig vorhanden, es gibt keine zerknitterten oder eingerissenen Seiten und im Text oder im Randbereich wurden keine Unterstreichungen, Markierungen oder Notizen vorgenommen. Der Inneneinband kann minimale Gebrauchsspuren aufweisen. Minimale Gebrauchsspuren. Genauere Einzelheiten sowie eine Beschreibung eventueller Mängel entnehmen Sie bitte dem Angebot des Verkäufers.

Oops! Looks like we're having trouble connecting to our server.

Refresh your browser window to try again.

Versand:

Kostenlos USPS Media MailTM.

Standort: Boston, Massachusetts, USA

Lieferung:

Lieferung zwischen Di, 14. Okt und Fr, 17. Okt nach 94104 bei heutigem Zahlungseingang

Rücknahme:

60 Tage Rückgabe. Käufer zahlt Rückversand. Wenn Sie ein eBay-Versandetikett verwenden, werden die Kosten dafür von Ihrer Rückerstattung abgezogen.

Zahlungen:

Sicher einkaufen

Der Verkäufer ist für dieses Angebot verantwortlich.

eBay-Artikelnr.:157378402010

Artikelmerkmale

- Artikelzustand

- Neuwertig

- Hinweise des Verkäufers

- “Like New Softcover, Clean, tight, no markings. Appears as unread”

- Personalized

- No

- Educational Level

- College, University, Adult & Further Education

- Level

- Advanced, Technical

- Country/Region of Manufacture

- United States

- ISBN

- 9780691145983

Über dieses Produkt

Product Identifiers

Publisher

Princeton University Press

ISBN-10

0691145989

ISBN-13

9780691145983

eBay Product ID (ePID)

109205840

Product Key Features

Number of Pages

400 Pages

Publication Name

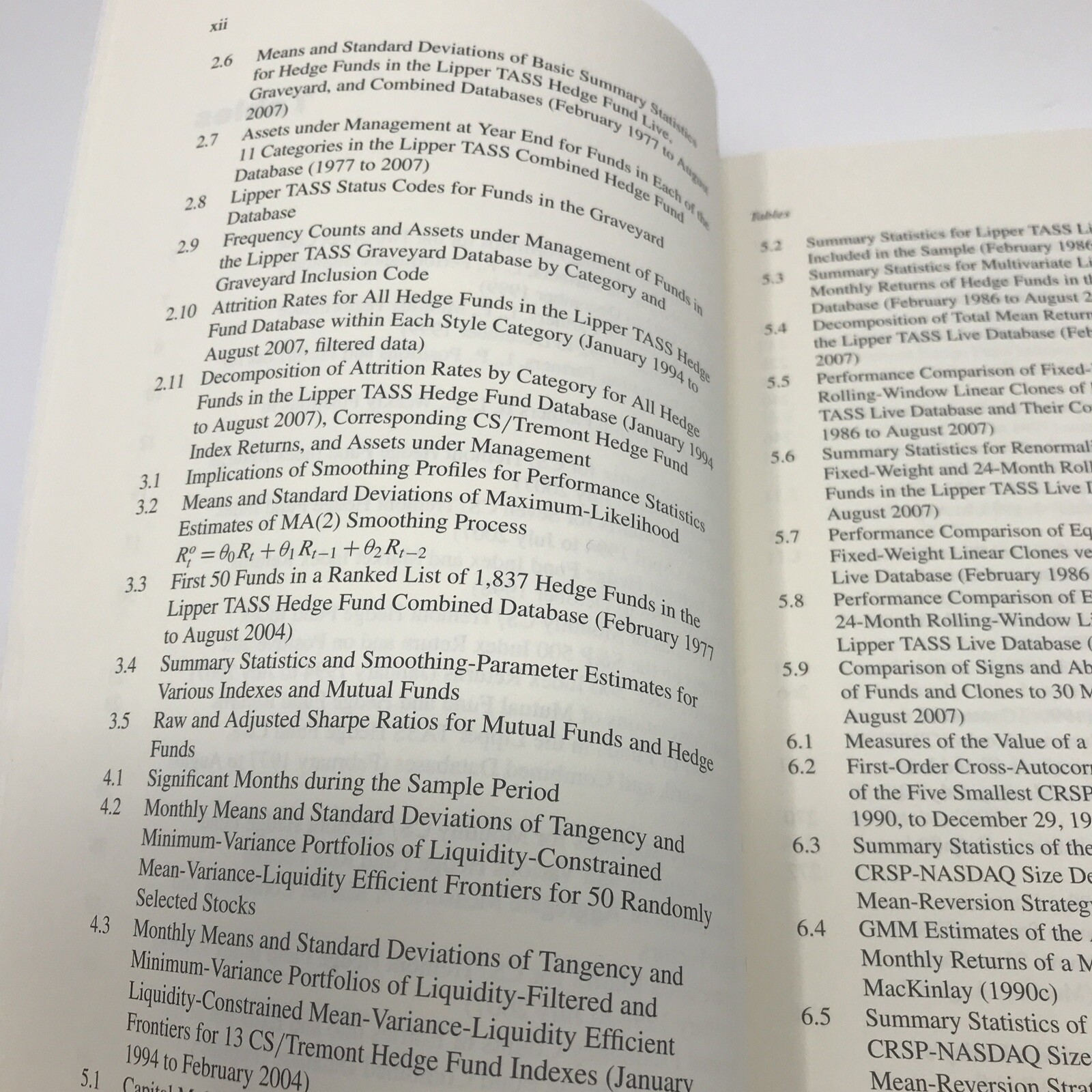

Hedge Funds : an Analytic Perspective-Updated Edition

Language

English

Subject

Finance / General, Investments & Securities / Mutual Funds, Corporate Finance / General, Investments & Securities / General

Publication Year

2010

Features

Revised

Type

Textbook

Subject Area

Business & Economics

Series

Advances in Financial Engineering Ser.

Format

Trade Paperback

Dimensions

Item Height

0.9 in

Item Weight

21.7 Oz

Item Length

9.1 in

Item Width

6.9 in

Additional Product Features

Intended Audience

College Audience

Reviews

"For scholars already familiar with the concepts of modern portfolio theory, the book is a good start in a quest to expand their knowledge of hedge funds strategies. . . . As one of the leading researchers in the field, Lo sets the standard by establishing key concepts for the industry with this book."-- Marcel Mllenbeck, Financial Markets and Portfolio Management, "Andrew Lo's Hedge Funds is likely to be the high-water mark in the analysis of hedge funds for years to come. Focusing on hedge fund returns and trading strategies, risk characteristics, and potential for illiquidity, Lo brings to bear his always fresh and insightful thinking." --Richard Bookstaber, author of A Demon of Our Own Design: Markets, Hedge Funds, and the Perils of Financial Innovation, "For scholars already familiar with the concepts of modern portfolio theory, the book is a good start in a quest to expand their knowledge of hedge funds strategies. . . . As one of the leading researchers in the field, Lo sets the standard by establishing key concepts for the industry with this book."-- Marcel Möllenbeck, Financial Markets and Portfolio Management, "For scholars already familiar with the concepts of modern portfolio theory, the book is a good start in a quest to expand their knowledge of hedge funds strategies. . . . As one of the leading researchers in the field, Lo sets the standard by establishing key concepts for the industry with this book." --Marcel Möllenbeck, Financial Markets and Portfolio Management, "This book provides a useful and very timely overview of key aspects of the hedge fund industry. It summarizes the basic properties of hedge fund returns, discusses why traditional performance measures may be misleading when analyzing hedge fund performance, and highlights important issues such as serial correlation, return smoothing, and illiquidity." --Markus K. Brunnermeier, Princeton University, For scholars already familiar with the concepts of modern portfolio theory, the book is a good start in a quest to expand their knowledge of hedge funds strategies. . . . As one of the leading researchers in the field, Lo sets the standard by establishing key concepts for the industry with this book., "Anyone who is considering investing in hedge funds, or is involved in regulating the financial-services industry, should give it a go."-- The Economist, "For scholars already familiar with the concepts of modern portfolio theory, the book is a good start in a quest to expand their knowledge of hedge funds strategies. . . . As one of the leading researchers in the field, Lo sets the standard by establishing key concepts for the industry with this book." --Marcel Mllenbeck, Financial Markets and Portfolio Management, "Andrew Lo is a major figure in finance so his new book on the fast-moving world of hedge funds ought to be in the must read category. . . . The book is the authoritative distillation into an accessible form of a huge amount of academic research and practical experience. . . . Professor Lo gives a masterful illustration of the problems in gauging hedge fund performance with his famous fantasy fund Capital Decimation Partners."-- Steven Bell, The Business Economist, "Finally a serious book on hedge funds based on real data, written by a leading financial economist." --Tyler Cowen, Marginal Revolution, "For scholars already familiar with the concepts of modern portfolio theory, the book is a good start in a quest to expand their knowledge of hedge funds strategies. . . . As one of the leading researchers in the field, Lo sets the standard by establishing key concepts for the industry with this book."-- Marcel M'llenbeck, Financial Markets and Portfolio Management, Andrew Lo is a major figure in finance so his new book on the fast-moving world of hedge funds ought to be in the 'must read' category. . . . The book is the authoritative distillation into an accessible form of a huge amount of academic research and practical experience. . . . Professor Lo gives a masterful illustration of the problems in gauging hedge fund performance with his famous fantasy fund Capital Decimation Partners., Finally a serious book on hedge funds based on real data, written by a leading financial economist. -- Tyler Cowen, Marginal Revolution, Anyone who is considering investing in hedge funds, or is involved in regulating the financial-services industry, should give it a go. -- The Economist, Finally a serious book on hedge funds based on real data, written by a leading financial economist. ---Tyler Cowen, Marginal Revolution, For scholars already familiar with the concepts of modern portfolio theory, the book is a good start in a quest to expand their knowledge of hedge funds strategies. . . . As one of the leading researchers in the field, Lo sets the standard by establishing key concepts for the industry with this book. -- Marcel Mllenbeck, Financial Markets and Portfolio Management, "Finally a serious book on hedge funds based on real data, written by a leading financial economist."-- Tyler Cowen, Marginal Revolution, "Andrew Lo is a major figure in finance so his new book on the fast-moving world of hedge funds ought to be in the 'must read' category. . . . The book is the authoritative distillation into an accessible form of a huge amount of academic research and practical experience. . . . Professor Lo gives a masterful illustration of the problems in gauging hedge fund performance with his famous fantasy fund Capital Decimation Partners."-- Steven Bell, The Business Economist, "Lo offers a truly unique perspective. He examines the properties of returns and illiquidity in great detail and introduces an innovative concept of mean-variance-liquidity optimization, something that no other book on hedge funds has addressed." --Narayan Y. Naik, London Business School, "Andrew Lo is a major figure in finance so his new book on the fast-moving world of hedge funds ought to be in the 'must read' category. . . . The book is the authoritative distillation into an accessible form of a huge amount of academic research and practical experience. . . . Professor Lo gives a masterful illustration of the problems in gauging hedge fund performance with his famous fantasy fund Capital Decimation Partners." --Steven Bell, The Business Economist, Andrew Lo is a major figure in finance so his new book on the fast-moving world of hedge funds ought to be in the 'must read' category. . . . The book is the authoritative distillation into an accessible form of a huge amount of academic research and practical experience. . . . Professor Lo gives a masterful illustration of the problems in gauging hedge fund performance with his famous fantasy fund Capital Decimation Partners. -- Steven Bell, The Business Economist, Andrew Lo is a major figure in finance so his new book on the fast-moving world of hedge funds ought to be in the 'must read' category. . . . The book is the authoritative distillation into an accessible form of a huge amount of academic research and practical experience. . . . Professor Lo gives a masterful illustration of the problems in gauging hedge fund performance with his famous fantasy fund Capital Decimation Partners. ---Steven Bell, The Business Economist, Anyone who is considering investing in hedge funds, or is involved in regulating the financial-services industry, should give it a go., For scholars already familiar with the concepts of modern portfolio theory, the book is a good start in a quest to expand their knowledge of hedge funds strategies. . . . As one of the leading researchers in the field, Lo sets the standard by establishing key concepts for the industry with this book. ---Marcel Möllenbeck, Financial Markets and Portfolio Management, "Anyone who is considering investing in hedge funds, or is involved in regulating the financial-services industry, should give it a go." -- The Economist

Dewey Edition

22

Series Volume Number

3

Illustrated

Yes

Dewey Decimal

332.64/524

Edition Description

Revised edition

Synopsis

The hedge fund industry has grown dramatically over the years. Originally intended for the wealthy, these private investments have attracted a much broader following that includes pension funds and retail investors. This book addresses the pressing need for a systematic framework for managing hedge fund investments., The hedge fund industry has grown dramatically over the last two decades, with more than eight thousand funds now controlling close to two trillion dollars. Originally intended for the wealthy, these private investments have now attracted a much broader following that includes pension funds and retail investors. Because hedge funds are largely unregulated and shrouded in secrecy, they have developed a mystique and allure that can beguile even the most experienced investor. In Hedge Funds, Andrew Lo--one of the world's most respected financial economists--addresses the pressing need for a systematic framework for managing hedge fund investments. Arguing that hedge funds have very different risk and return characteristics than traditional investments, Lo constructs new tools for analyzing their dynamics, including measures of illiquidity exposure and performance smoothing, linear and nonlinear risk models that capture alternative betas, econometric models of hedge fund failure rates, and integrated investment processes for alternative investments. In a new chapter, he looks at how the strategies for and regulation of hedge funds have changed in the aftermath of the financial crisis., The hedge fund industry has grown dramatically over the last two decades, with more than eight thousand funds now controlling close to two trillion dollars. Originally intended for the wealthy, these private investments have now attracted a much broader following that includes pension funds and retail investors. Because hedge funds are largely unregulated and shrouded in secrecy, they have developed a mystique and allure that can beguile even the most experienced investor. In Hedge Funds , Andrew Lo--one of the world's most respected financial economists--addresses the pressing need for a systematic framework for managing hedge fund investments. Arguing that hedge funds have very different risk and return characteristics than traditional investments, Lo constructs new tools for analyzing their dynamics, including measures of illiquidity exposure and performance smoothing, linear and nonlinear risk models that capture alternative betas, econometric models of hedge fund failure rates, and integrated investment processes for alternative investments. In a new chapter, he looks at how the strategies for and regulation of hedge funds have changed in the aftermath of the financial crisis.

LC Classification Number

HG4530.L59 2010

Artikelbeschreibung des Verkäufers

Info zu diesem Verkäufer

Larry-BOS

100% positive Bewertungen•1.1 Tsd. Artikel verkauft

Angemeldet als gewerblicher Verkäufer

Verkäuferbewertungen (392)

- m***m (454)- Bewertung vom Käufer.Letzter MonatBestätigter KaufGreat, thank you. Andy

- eBay automated feedback- Bewertung vom Käufer.Letzter MonatOrder delivered on time with no issues

- eBay automated feedback- Bewertung vom Käufer.Letzter MonatOrder delivered on time with no issues

Noch mehr entdecken:

- Analytische Chemie Studium und Erwachsenenbildung,

- Deutsche Studium und Erwachsenenbildung Analytische Chemie,

- Andrew Gross Belletristik-Bücher,

- Andrew Gross Belletristik-Bücher im Taschenbuch-Format,

- W. - Somerset-Maugham-Belletristik-Bücher,

- W. - Somerset-Maugham-Taschenbuch-Belletristik - Bücher,

- Deutsche Bücher W. - Somerset-Maugham-Belletristik