Bild 1 von 2

Galerie

Bild 1 von 2

Ähnlichen Artikel verkaufen?

Finanz-Kleinge

US $15,00

Ca.CHF 12,06

oder Preisvorschlag

Artikelzustand:

Neuwertig

Buch, das wie neu aussieht, aber bereits gelesen wurde. Der Einband weist keine sichtbaren Gebrauchsspuren auf. Bei gebundenen Büchern ist der Schutzumschlag vorhanden (sofern zutreffend). Alle Seiten sind vollständig vorhanden, es gibt keine zerknitterten oder eingerissenen Seiten und im Text oder im Randbereich wurden keine Unterstreichungen, Markierungen oder Notizen vorgenommen. Der Inneneinband kann minimale Gebrauchsspuren aufweisen. Minimale Gebrauchsspuren. Genauere Einzelheiten sowie eine Beschreibung eventueller Mängel entnehmen Sie bitte dem Angebot des Verkäufers.

Oops! Looks like we're having trouble connecting to our server.

Refresh your browser window to try again.

Versand:

US $4,75 (ca. CHF 3,82) USPS Media MailTM.

Standort: River Forest, Illinois, USA

Lieferung:

Lieferung zwischen Do, 7. Aug und Mi, 13. Aug nach 94104 bei heutigem Zahlungseingang

Rücknahme:

30 Tage Rückgabe. Käufer zahlt Rückversand. Wenn Sie ein eBay-Versandetikett verwenden, werden die Kosten dafür von Ihrer Rückerstattung abgezogen.

Zahlungen:

Sicher einkaufen

Der Verkäufer ist für dieses Angebot verantwortlich.

eBay-Artikelnr.:187182505813

Artikelmerkmale

- Artikelzustand

- Brand

- Unbranded

- MPN

- Does not apply

- ISBN

- 9780471433477

Über dieses Produkt

Product Identifiers

Publisher

Wiley & Sons, Incorporated, John

ISBN-10

0471433470

ISBN-13

9780471433477

eBay Product ID (ePID)

2469210

Product Key Features

Book Title

Financial Fine Print : Uncovering a Company's True Value

Number of Pages

208 Pages

Language

English

Publication Year

2003

Topic

Accounting / General, Investments & Securities / Stocks, Personal Finance / General, Investments & Securities / General

Illustrator

Yes

Genre

Business & Economics

Format

Hardcover

Dimensions

Item Height

0.8 in

Item Weight

15.1 Oz

Item Length

9.2 in

Item Width

6.3 in

Additional Product Features

Intended Audience

Trade

LCCN

2003-010886

Dewey Edition

22

Reviews

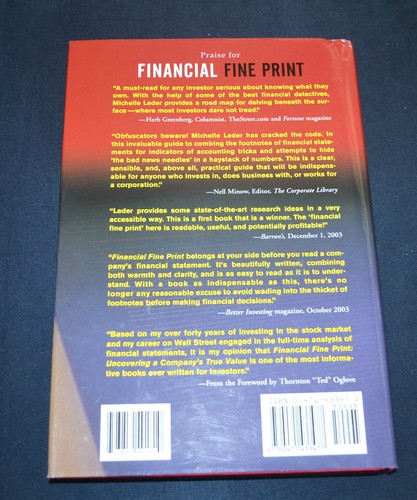

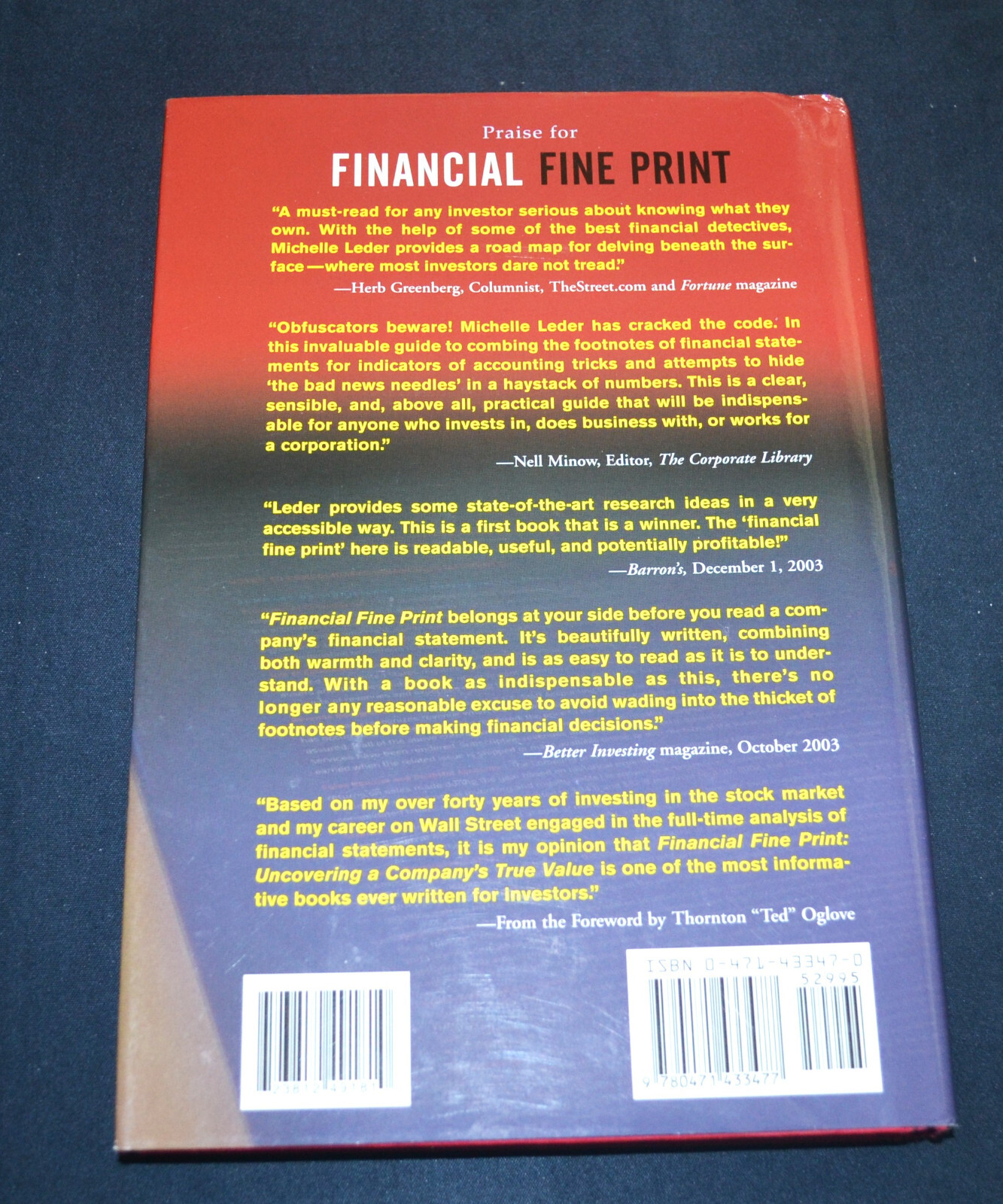

"A must read for any investor serious about knowing what they own." (Herb Greenberg, Columnist, TheStreet.com, Fortune Magazine ) "It's beautifully written, combining both warmth and clarity, and as easy to read as it is to understand." ( Better Investing Magazine , October 2003) "The Financial Fine Print here is readable, useful and potentially profitable!" ( Barron's Magazine, December 1, 2003) "In my opinion "Financial Fine Print" is a must-read for any investor who wants to pick his or her own stocks." ( Pittsburgh Tribune , December 21, 2003) "With a book as indispensable as this, there's no excuse to avoid wading into the thicket of footnotes before making financial decisions." ( Better Investing Magazine , December 2003) "Financial Fine Print: Uncovering a Company's True Value is one of the most informative books ever written for investors" (From the Foreword by Thornton "Ted" Oglove), "A must read for any investor serious about knowing what they own." (Herb Greenberg, Columnist, TheStreet.com, Fortune Magazine ) "It's beautifully written, combining both warmth and clarity, and as easy to read as it is to understand." ( Better Investing Magazine , October 2003) "The Financial Fine Print here is readable, useful and potentially profitable!" ( Barron's Magazine, December 1, 2003) "In my opinion "Financial Fine Print" is a must-read for any investor who wants to pick his or her own stocks." ( Pittsburgh Tribune , December 21, 2003) "With a book as indispensable as this, there's no...excuse to avoid wading into the thicket of footnotes before making financial decisions." ( Better Investing Magazine , December 2003) "Financial Fine Print: Uncovering a Company's True Value is one of the most informative books ever written for investors" (From the Foreword by Thornton "Ted" Oglove)

Dewey Decimal

332.632042

Table Of Content

Foreword. Acknowledgments. Introduction. Chapter 1: Don't Get Fooled Again. Chapter 2: Reading the Fine Print Like a Pro. Chapter 3: You Don't Need to Be a Pro. Chapter 4: Charge It!. Chapter 5: Optional Illusions. Chapter 6: All in the Family. Chapter 7: Pensions in Wonderland. Chapter 8: Debt by Many Other Names. Chapter 9: Five Common Ingredients. Chapter 10: Changing the World. A Few Final Words. Appendix A: A Cheat Sheet for Reading Key SEC Filings. Appendix B: A Brief Walk through Qwest's Fine Print. Notes. Index.

Synopsis

"A must-read for any investor serious about knowing what they own. With the help of some of the best financial detectives, Michelle Leder provides a roadmap for delving beneath the surface where most investors dare not tread." Herb Greenberg, Columnist, TheStreet.com and Fortune magazine "Obfuscators beware! Michelle Leder has cracked the code. In this invaluable guide to combing the footnotes of financial statements for indicators of accounting tricks and attempts to hide the bad news needles in a haystack of numbers. This is a clear, sensible, and, above all, practical guide that will be indispensable for anyone who invests in, does business with, or works for a corporation." Nell Minow, Editor, The Corporate Library "Too many companies would prefer that you not read the footnotes," observes former SEC chairman Arthur Levitt. "That should be incentive enough to delve into them." In fact, not only do companies prefer you ignore the details they are required to report the pesky particulars on exactly how they account for those whopping earnings they take calculated steps to make this information as hard as possible to understand. But for those who know how to look, the facts that predict a company's true prospects are usually hidden in plain sight. Financial Fine Print gives you the tools you need to break down annual reports and SEC filings, make sense of the deliberately cryptic language of footnotes, and get the real goods on a potential investment. To make money in today's tough market, investors have to make deliberate, well-researched choices. To do this requires not only having the right information, but also knowing how to decode it. With their obscuring tactics, companies won't help you any. So be advised: those who would help themselves and expect to profit should get down to the nitty-gritty of Financial Fine Print., Thirty-five million individual investors jumped into the stock market for the first time during the late 1990s without asking questions about the stocks they were buying. When the bubble burst and the large number of accounting scandals began to grow, most investors didn't know where to turn or whom to trust. Now it has become more important than ever for investors to take matters into their own hands. Financial Fine Print: Uncovering a Company's True Value lets individual investors in on the secrets that seasoned professional investors use when they evaluate a potential investment. Buried deep in a company's quarterly (10-Q) and annual (10-K) reports are the real clues to a company's financial health: the footnotes. At many large companies, these footnotes can run for more than 30 pages and for some corporations have doubled in the past five years, making them simply too important for investors to ignore. Financial Fine Print spells out exactly what investors need to look for within the footnotes of a company's reports in order to make better, more informed decisions. By using numerous examples of actual footnotes that have appeared in SEC documents, the book teaches investors in easy-to-understand language ways to spot - and avoid - future Enrons and Worldcoms (and Tycos and Adelphias and HealthSouths). For any investor who has spent the past three years watching their investments shrink and has begun to think about getting back into the market, this book provides the critical tools that investors need to know to avoid getting burned once again., Thirty-five million individual investors jumped into the stock market for the first time during the late 1990s without asking questions about the stocks they were buying. When the bubble burst and the large number of accounting scandals began to grow, most investors didn t know where to turn or whom to trust.

LC Classification Number

HG4028.V3L43 2003

Artikelbeschreibung des Verkäufers

Info zu diesem Verkäufer

blinker12

100% positive Bewertungen•10 Tsd. Artikel verkauft

Angemeldet als privater VerkäuferDaher finden verbraucherschützende Vorschriften, die sich aus dem EU-Verbraucherrecht ergeben, keine Anwendung. Der eBay-Käuferschutz gilt dennoch für die meisten Käufe.

Beliebte Kategorien in diesem Shop

Verkäuferbewertungen (5'417)

- f***s (970)- Bewertung vom Käufer.Letzter MonatBestätigter KaufThank you so much ☺️

- l***a (1092)- Bewertung vom Käufer.Letzter MonatBestätigter Kaufnice

- o***o (1313)- Bewertung vom Käufer.Letzter MonatBestätigter KaufThanks! Excellent! AAAA+++++

Noch mehr entdecken:

- Zeitschriften über Geld & Finanzen,

- Buch über Biographien und Wahre Geschichten auf Deutsch,

- Buch über Biographien und Wahre Geschichten auf Englisch,

- Bücher über Wahre Geschichten Sachbuch,

- Monatliche Zeitschriften über Geld & Finanzen,

- Biografien- & - wahre-Geschichten-Sachbuch Bücher,

- Taschenbuch über Biographien und Wahre Geschichten,

- Bücher Biografien- & - wahre-Geschichten-Sachbuch Bücher,

- Biografien- & - wahre-Geschichten-Sachbuch-Erwachsene Bücher,

- Biografien- & - wahre-Geschichten-Sachbuch-Jugendliche Bücher